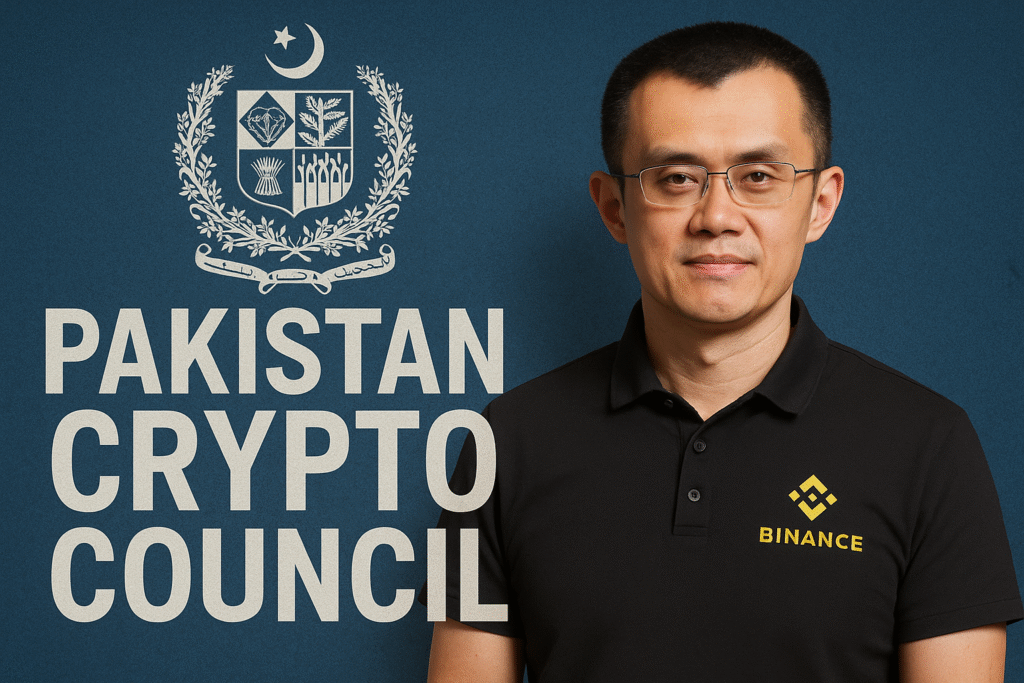

In a move signaling a tectonic shift in its financial strategy, Pakistan launched the Pakistan Crypto Council (PCC) in March 2025, marking its formal entry into the global digital asset arena. The council, backed by the Ministry of Finance and chaired by Federal Finance Minister Muhammad Aurangzeb, aims to regulate blockchain technology, foster innovation, and position the country as a regional hub for Web3 and digital finance . The appointment of Changpeng “CZ” Zhao, the controversial founder of Binance, as the PCC’s strategic advisor in April 2025 has further amplified both excitement and skepticism about Pakistan’s crypto ambitions. This article evaluates the implications of these developments for Pakistan’s public finances and economic future.

A New Regulatory Dawn:

The PCC’s formation represents a dramatic reversal from Pakistan’s historically cautious stance on cryptocurrencies. Until 2024, the State Bank of Pakistan (SBP) had banned financial institutions from processing crypto transactions, citing risks of money laundering and volatility . However, mounting pressure from a young, tech-savvy population—60% under 30—and the global crypto boom under U.S. President Donald Trump’s pro-digital asset policies prompted a rethink . The council’s mandate includes creating a regulatory framework aligned with Financial Action Task Force (FATF) guidelines, attracting foreign investment, and integrating blockchain into public infrastructure, such as tokenizing state-owned enterprises .

CZ’s appointment as advisor adds star power to these efforts. Despite his 2023 conviction in the U.S. for anti-money laundering violations, his expertise in scaling Binance into the world’s largest crypto exchange is seen as critical to Pakistan’s aspirations. Finance Minister Aurangzeb described the move as a “landmark moment,” emphasizing CZ’s role in guiding infrastructure development, education, and regulatory compliance .

Public Finance Implications:

The PCC’s launch coincides with a fragile economic landscape. Pakistan narrowly avoided default in 2023, and a recent stock market crash—the KSE-100 Index plummeted 3,882 points in April 2025—has heightened urgency for diversification . Proponents argue that regulated crypto adoption could unlock multiple fiscal benefits:

1. Tax Revenue and Formalization: With an estimated 15–20 million Pakistanis already holding crypto assets, formalizing the sector could generate significant tax revenue. Bilal Bin Saqib, PCC CEO, highlighted that offshore platforms currently operate untaxed, depriving the state of potential earnings . A regulated framework would mandate compliance with anti-money laundering (AML) laws and capital gains taxes, aligning with FATF requirements .

2. Foreign Investment: By positioning itself as a crypto-friendly jurisdiction, Pakistan aims to attract global blockchain firms and investors. CZ’s involvement could catalyze partnerships, such as Binance’s $2 billion investment in South Asia through Abu Dhabi’s MGX . The government also plans to leverage blockchain for public infrastructure projects, potentially reducing costs and increasing transparency .

3. Financial Inclusion: Crypto adoption could empower Pakistan’s unbanked population, which stands at 77%. Decentralized finance (DeFi) platforms might offer accessible savings and lending tools, though this depends on improving digital infrastructure—a noted challenge given Pakistan’s low global rankings in internet speed and reliability .

Risks and Challenges:

Critics warn that the PCC’s ambitions may outpace Pakistan’s institutional capacity. CZ’s checkered legal history raises concerns about oversight, particularly after the Tehreek-e-Taliban Pakistan (TTP) announced plans to use Binance for fundraising . Regulatory overreach could also stifle innovation, while under-regulation might expose the economy to volatility and illicit flows. Ibrahim Khalil, a finance expert, questioned the prioritization of crypto over systemic issues like energy shortages and inflation, arguing that blockchain “solves problems Pakistan doesn’t have”

Moreover, the energy-intensive nature of crypto mining clashes with Pakistan’s chronic power deficits. While proponents suggest nuclear energy as a solution, skeptics point to El Salvador’s struggles with Bitcoin adoption as a cautionary tale .

The Road Ahead :

The PCC’s success hinges on balancing innovation with prudence. Collaborative efforts with international regulators, robust AML frameworks, and investments in digital infrastructure will be critical. If managed effectively, crypto could diversify Pakistan’s economy, stabilize remittance flows (which totaled $30 billion in 2024), and create high-tech jobs for its youth .

However, the government must tread carefully. As Ali Farid Khwaja, chairman of KTrade Securities, noted, “Regulation doesn’t mean endorsement.” Pakistan’s ability to mitigate risks while harnessing crypto’s potential will determine whether this bold experiment becomes a blueprint for emerging economies or a cautionary tale of overreach .

This article was published on www.publicfinance.pk.