Each year, the Government of Pakistan unveils the federal budget, a document that outlines the country’s spending priorities, expected revenues, and fiscal direction. Yet, for many citizens, understanding how their tax money is actually spent remains a mystery. In this article, we break down where Pakistan’s revenue comes from and how it is distributed.

Revenue Sources

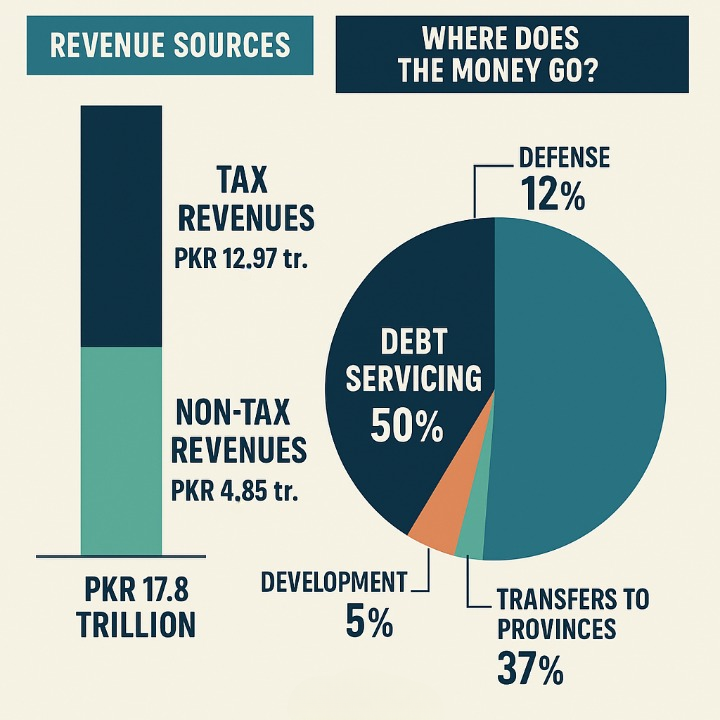

Pakistan’s revenue primarily stems from tax and non-tax sources. In the 2024-25 federal budget, total revenues are projected at PKR 17.8 trillion. Of this, tax revenues account for PKR 12.97 trillion, with the Federal Board of Revenue (FBR) collecting the lion’s share. The remaining PKR 4.845 trillion comes from non-tax revenues such as petroleum levies, dividends from state-owned enterprises, and mark-up from public sector entities.

Where Does the Money Go?

A substantial portion of the budget goes towards current expenditures (PKR 17.2 trillion), of which over PKR 8.7 trillion is allocated to debt servicing alone. This means nearly half of the federal government’s expenditure goes into paying interest on domestic and external loans. Defense spending stands at approximately PKR 2.1 trillion, representing another major slice of the pie.

Transfers to provinces under the National Finance Commission (NFC) Award are the third largest component, estimated at PKR 6.6 trillion. These funds are used by provinces for education, health, agriculture, and local infrastructure.

Development spending, often seen as the engine of growth, receives PKR 950 billion under the Public Sector Development Programme (PSDP). However, this figure is dwarfed by current expenditures, reflecting structural challenges in rebalancing priorities.

What Citizens Get

Spending on education, health, and social protection remains modest relative to debt and defense. For instance, the federal allocation for health is just over PKR 37 billion, and education receives around PKR 90 billion. While some social safety net programs like BISP and Ehsaas are well-funded, they still pale in comparison to debt payments.

Key Takeaway

The budget is not just a financial document—it is a reflection of the government’s priorities. If nearly half the budget is spent on debt servicing, it indicates a need for fiscal reforms and revenue mobilization. As citizens, understanding where our taxes go can empower us to demand better public services and more transparent governance.