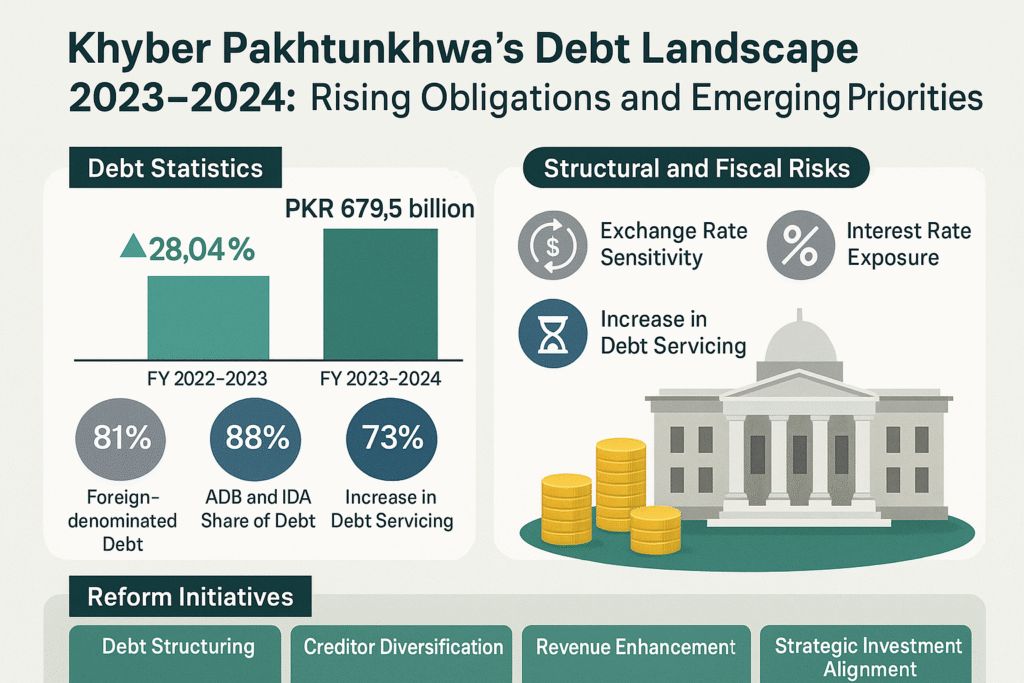

Khyber Pakhtunkhwa’s (KP) latest Debt Statistical Bulletin for FY 2023–2024 offers a critical look at the province’s evolving debt profile. The total debt stock rose by 28.04%, reaching PKR 679.5 billion, largely driven by currency depreciation and new loan inflows. While the provincial government has shown commendable intent through frameworks such as the Fiscal Responsibility and Debt Management Act (FRDMA) 2022, rising liabilities and structural imbalances call for urgent and focused reforms.

Debt Composition and Growth Drivers

Between FY 2022–2023 and FY 2023–2024, KP’s debt rose from PKR 530.7 billion to PKR 679.5 billion. The sharp rise was fueled by:

- A 13.73% depreciation of the Pakistani Rupee, which inflated foreign debt servicing by PKR 72.9 billion.

- Net disbursements amounting to PKR 75.9 billion, with new loan inflows of PKR 100.8 billion exceeding repayments of PKR 24.8 billion.

KP’s debt portfolio is predominantly foreign-denominated, with 81% of liabilities in USD. The Asian Development Bank (ADB) and the International Development Association (IDA) jointly account for 88% of total debt. Debt servicing for FY 2024–2025 is budgeted at PKR 67 billion—up 73% from the previous year.

Structural and Fiscal Risks

The province faces mounting risks:

- Exchange Rate Sensitivity: 99.4% of KP’s debt is in foreign currency, making the province highly vulnerable to PKR depreciation. A 1% fall in the exchange rate could substantially increase debt obligations.

- Interest Rate Exposure: Floating-rate loans, particularly from the ADB, constitute 69% of interest payments. In FY 2023–2024, ADB loans alone added PKR 8.2 billion in variable interest charges.

- Maturity and Refinancing Pressures: The average time to maturity declined to 9.9 years, with 8.94% of debt maturing within a year. This compresses KP’s fiscal space, especially under tight liquidity conditions.

- Debt Servicing Burden: Debt servicing represented 4.11% of provincial receipts in FY 2023–2024, projected to rise to 5.13% in the next fiscal year. This is compounded by low own-source revenues, which accounted for just 7% of KP’s total income.

- Sectoral Allocation Gaps: Infrastructure dominates debt usage—transport and energy account for 43% of total debt—while social sectors such as health and education receive only 5%. This imbalance raises concerns about long-term human capital development.

Reform Pathways and Strategic Interventions

- Debt Structuring: Rebalancing the portfolio by replacing variable-rate loans with fixed-rate instruments can mitigate interest risk. For instance, IDA loans (fully fixed) generated PKR 3.5 billion in interest costs versus PKR 9 billion for ADB loans.

- Creditor Diversification: The province should explore concessional financing options beyond ADB and IDA, such as through AIIB or dedicated climate financing platforms.

- Revenue Enhancement: KP’s own receipts rose to PKR 76.2 billion, representing just 8% of income. Expanding the tax base—particularly in property and agriculture—and strengthening collection mechanisms are critical for reducing fiscal dependence.

- Strategic Investment Alignment: Greater allocation toward high-impact sectors such as renewable energy, tourism, and agriculture is warranted. Projects like the KP Integrated Tourism Development initiative (PKR 12.3 billion) show potential for inclusive growth. Simultaneously, prioritizing education and healthcare could yield higher long-term returns.

- Operationalizing FRDMA: The 2022 FRDMA offers a solid foundation for debt accountability. However, implementation must include rigorous cost-benefit analyses for new borrowing, strict adherence to debt ceilings, and periodic review mechanisms.

- Currency Risk Mitigation: Collaborating with the State Bank of Pakistan to introduce hedging instruments (e.g., swaps, forwards) and encouraging PKR-denominated lending by multilateral partners could reduce foreign exchange exposure.

The provincial debt narrative reflects both ambition and fragility. While progress has been made in disclosure and infrastructure development, maintaining fiscal stability will require a deliberate shift toward sustainability, sectoral balance, and policy discipline. The institutional mechanisms now exist—what remains is consistent, reform-minded execution.

This Article was published on www.publicfinance.pk.