Introduction

The Government of Punjab, Pakistan, faces significant fiscal challenges, with public debt playing a central role in its economic planning. The recently released DB-D24 debt report by the Punjab Finance Department offers deep insights into the province’s debt profile as of June 30, 2023. This article delves into the debt structure, major concerns, and opportunities available for improving debt sustainability.

Overview of Punjab’s Debt Portfolio

As of June 30, 2023, Punjab’s total public debt stood at PKR 956.4 billion, marking an increase of 15% from the previous fiscal year. The debt is primarily sourced from foreign loans, with a notable contribution from domestic institutions.

Debt Composition (as of June 30, 2023)

| Source of Debt | Amount (PKR Billion) | Share (%) |

| Foreign Loans | 806.5 | 84.3% |

| Domestic Loans | 149.9 | 15.7% |

| Total Public Debt | 956.4 | 100% |

Foreign debt dominates the province’s borrowings, much of which is project-specific and often concessional in nature, coming from multilateral and bilateral donors.

Key Issues Identified

1. Rising Debt Servicing Costs

Debt servicing continues to consume a substantial portion of the annual budget. In FY2022-23, PKR 62.3 billion was allocated for debt servicing — a 22% increase compared to the previous fiscal year. This trend limits fiscal space for development expenditures.

2. Exchange Rate Vulnerability

With more than 80% of Punjab’s debt denominated in foreign currencies, fluctuations in the exchange rate significantly affect the real value of repayments. The recent depreciation of the Pakistani Rupee has led to an increase in the rupee cost of foreign debt.

3. Concentration of Project Loans

A significant chunk of debt is tied to infrastructure and energy-related projects, often with long gestation periods. Delays in execution or underutilization reduce the economic returns and increase repayment stress.

4. Weak Revenue Mobilization

Punjab’s own-source revenue remains low relative to its expenditure obligations. The reliance on federal transfers makes it vulnerable to national fiscal fluctuations, limiting its ability to service debt independently.

Trends Over the Past Five Years

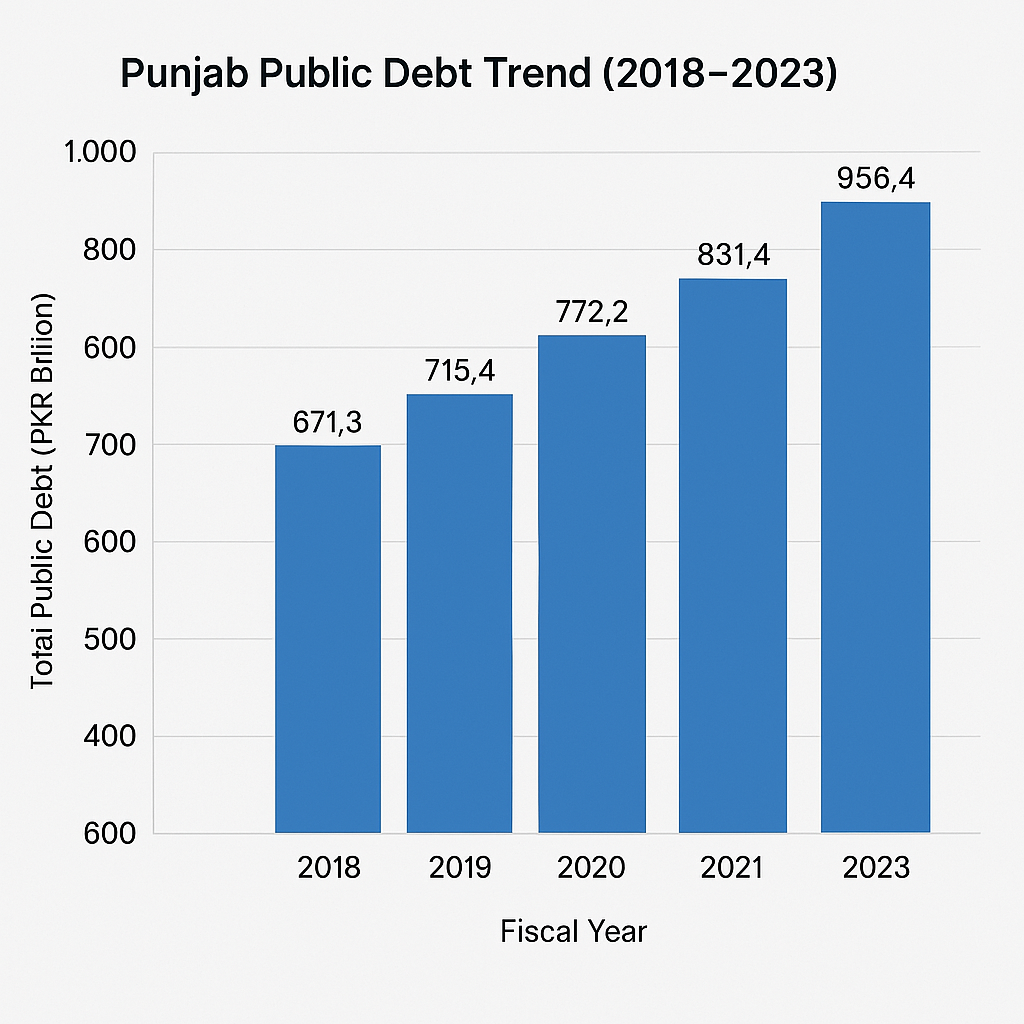

The province’s public debt has seen a consistent upward trend, driven by both increased development needs and currency depreciation.

Punjab Public Debt (2018–2023)

| Fiscal Year | Total Debt (PKR Billion) | Annual Growth (%) |

| 2018 | 612.1 | – |

| 2019 | 671.3 | 9.7% |

| 2020 | 715.4 | 6.6% |

| 2021 | 772.2 | 7.9% |

| 2022 | 831.4 | 7.7% |

| 2023 | 956.4 | 15.0% |

📊 Graph: Punjab Public Debt Trend (2018–2023)

(Bar chart showing year-wise increase in total public debt)

Opportunities for Fiscal Improvement

Despite the debt concerns, Punjab can steer toward fiscal sustainability through the following avenues:

1. Expanding Own Revenue Base

Strengthening the Punjab Revenue Authority (PRA), reforming property and agriculture tax systems, and digitizing tax collection can boost internal revenues. Improved compliance and enforcement would also help.

2. Debt Restructuring and Reprofiling

Negotiating longer maturities and lower interest rates on existing debt, especially domestic obligations, could ease near-term fiscal pressures.

3. Leveraging Public-Private Partnerships (PPPs)

Shifting from debt-funded infrastructure to PPPs would reduce upfront capital outlays while transferring part of the risk to private stakeholders.

4. Prioritizing High-Return Projects

Ensuring that borrowed funds are invested in projects with strong economic and social returns (like irrigation, health, and education) will improve the debt-to-GDP and debt-to-revenue ratios in the long run.

5. Improving Project Execution Efficiency

Fast-tracking implementation and improving the capacity of executing agencies will help maximize returns on borrowed capital.

Punjab’s debt situation, while currently manageable, poses clear long-term sustainability challenges. With an 84% share of foreign loans, the province remains exposed to currency and refinancing risks. However, with improved revenue mobilization, disciplined borrowing, and strategic investments, the government can turn this challenge into an opportunity for structural fiscal reforms.

A proactive approach, involving institutional strengthening, transparent debt management, and greater financial autonomy, will be essential in ensuring that public debt remains a tool for development rather than a fiscal burden.