Introduction

The financial health of a province is best reflected through its revenue performance. The receipts report of the Punjab Finance Department for FY2024–25 (covering actual accounts up to February 2025) provides a snapshot of the government’s fiscal mobilization capabilities. This article evaluates Punjab’s revenue collection compared to the annual budget estimates for FY2024–25 and the actual receipts of FY2023–24, highlighting key trends, shortfalls, and areas of improvement.

Overview of Total Receipts

As of February 2025, Punjab recorded actual receipts amounting to PKR 1,901.4 billion, against a full-year budget estimate of PKR 3,226.2 billion, achieving 58.9% of the target in the first eight months of the fiscal year.

| Category | Budget Estimate FY25 (PKR Bn) | Actual FY25 (Till Feb) | % of Budget Achieved | Actual FY24 (PKR Bn) |

| Total Receipts | 3,226.2 | 1,901.4 | 58.9% | 2,777.2 |

This performance suggests that the province is broadly on track, though a sharper revenue push will be required in the final quarter to meet targets.

Breakdown by Key Classifications

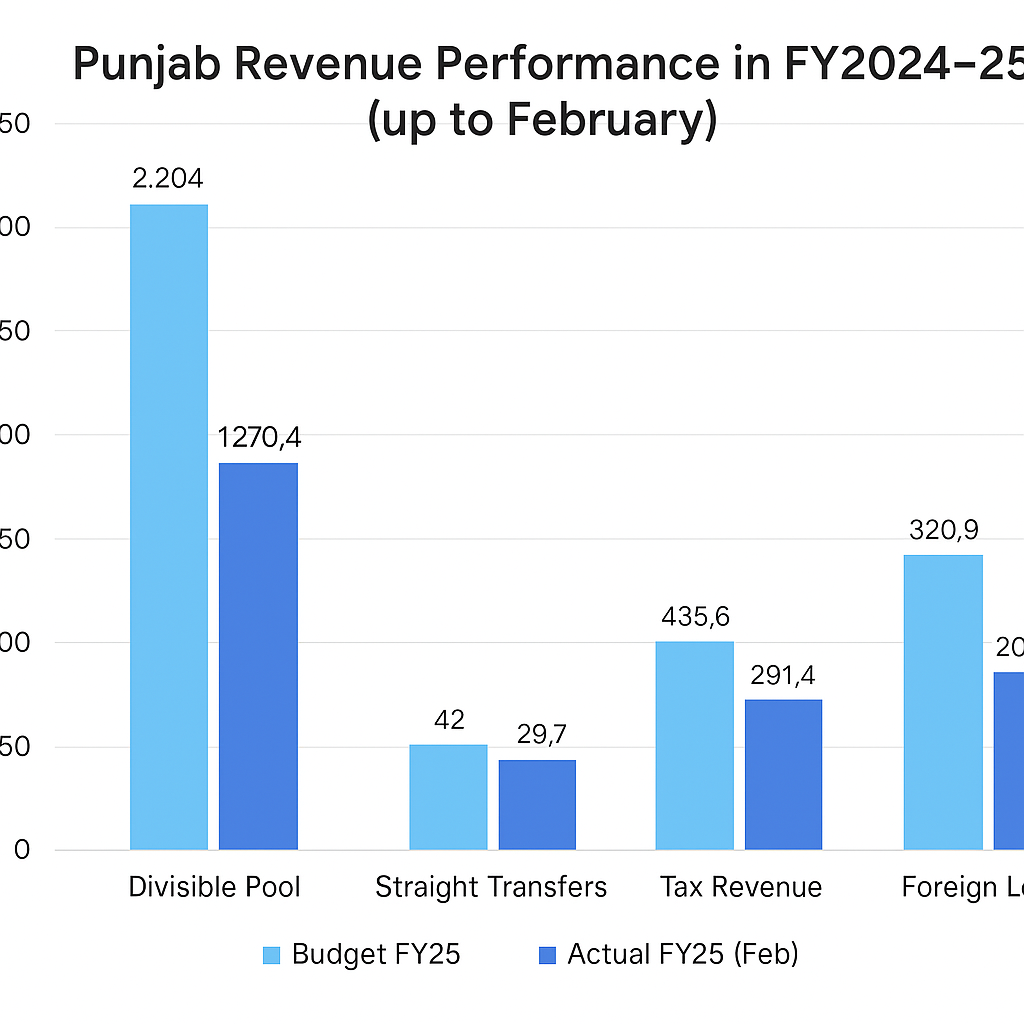

1. Federal Transfers (Divisible Pool and Straight Transfers)

| Source | Budget FY25 | Actual FY25 (Feb) | % Achieved | Actual FY24 |

| Divisible Pool | 2,204.0 | 1,270.4 | 57.7% | 1,932.9 |

| Straight Transfers (Oil & Gas, etc.) | 42.0 | 29.7 | 70.7% | 33.3 |

Federal transfers make up the bulk of Punjab’s revenue, and while the divisible pool has lagged slightly in percentage terms, straight transfers are performing better.

2. Provincial Own Receipts

| Type | Budget FY25 | Actual FY25 (Feb) | % Achieved | Actual FY24 |

| Tax Revenue | 435.6 | 291.4 | 66.9% | 392.1 |

| Non-Tax Revenue | 190.7 | 125.2 | 65.7% | 135.0 |

| Total Provincial Own | 626.3 | 416.6 | 66.5% | 527.1 |

The provincial own-source revenue collection has performed relatively well, achieving nearly two-thirds of the annual estimate in two-thirds of the year. However, actual receipts have still fallen short compared to FY2023–24 figures.

3. Capital Receipts and Loans

| Category | Budget FY25 | Actual FY25 (Feb) | % Achieved | Actual FY24 |

| Domestic Loans | 75.0 | 0.0 | 0.0% | 13.2 |

| Foreign Loans (Project Aid) | 320.9 | 206.1 | 64.2% | 171.1 |

Notably, there has been no domestic loan mobilization so far this year, while foreign loans are progressing steadily. The reliance on foreign loans continues to rise in absolute terms.

Key Observations

- Federal Transfers Lag Slightly Behind Targets Despite being the primary revenue source, federal transfers under the divisible pool have underperformed compared to the same period last year. This may be due to lower-than-expected FBR collections or delays in distribution.

- Decent Performance in Provincial Revenues Punjab’s tax and non-tax revenue collections are roughly on track, showing resilience despite economic headwinds. The 66.9% achievement in tax revenues is commendable.

- No Utilization of Domestic Borrowing The complete absence of domestic loan receipts suggests either delayed borrowing plans or a temporary strategy to reduce fiscal burden. However, this may cause stress in development funding later in the year if not compensated by other receipts.

- Foreign Loans Continue to Grow Foreign funding for projects remains vital for Punjab’s development financing. With 64.2% of the budgeted foreign aid already received, this segment appears better managed than others.

- Comparison with Previous Year While overall collections in FY2025 (to Feb) are promising in percentage terms, they remain behind FY2024 absolute figures (PKR 1,901.4 billion vs. PKR 2,777.2 billion full year). If trends continue, total receipts in FY25 might still fall short of the previous year unless there is a significant boost in the final quarter.

Punjab’s receipt performance for FY2024–25 (up to February) presents a mixed picture. The province has made reasonable progress, especially in its own-source revenue collection and foreign aid receipts. However, the underperformance in federal transfers and the non-utilization of domestic loans are concerning.

To meet the annual revenue target, the Punjab government must focus on:

- Ensuring timely and full realization of federal shares.

- Expanding tax base through improved compliance.

- Exploring alternative financing instruments.

- Accelerating disbursements from foreign-funded projects.

If these steps are implemented effectively, Punjab can not only meet its FY25 targets but also build stronger fiscal resilience going forward.