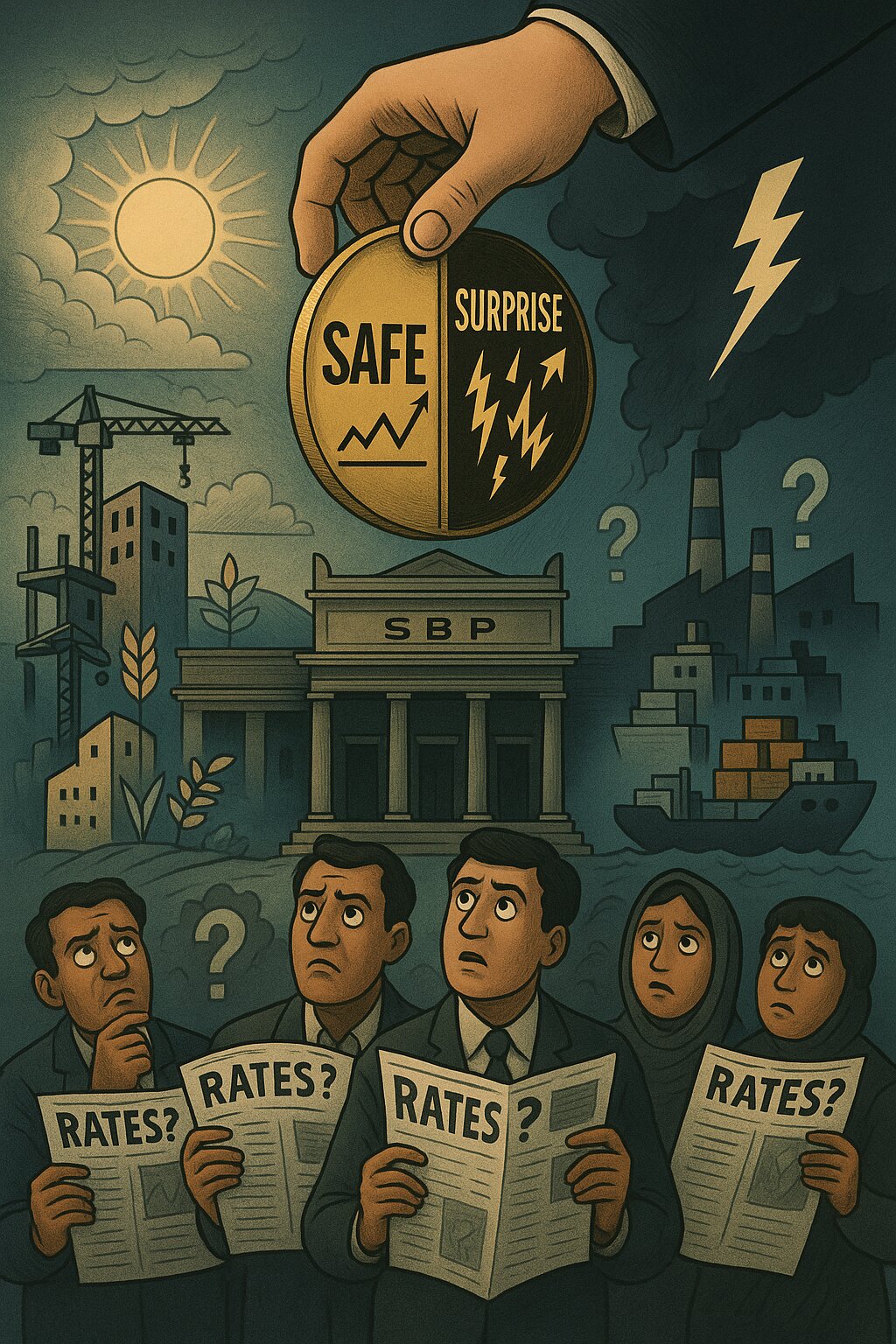

At a time when inflation has begun to soften and the rupee remains relatively stable, all eyes are now on the State Bank of Pakistan (SBP) as it prepares to announce its monetary policy stance in May 2025. The question on everyone’s mind—businesses, investors, policymakers, and households alike—is whether the central bank will move the benchmark policy rate from its current level of 12%, which has remained unchanged since January 2025.

The answer, it appears, is increasingly tilting toward a cautious status quo.

A Cooling Inflation Outlook

Recent economic indicators suggest that headline inflation has begun to decline meaningfully. The Pakistan Bureau of Statistics (PBS) reported that monthly inflation fell to 0.30% in April 2025, the lowest in years, down from 0.70% in March. This softening trend has emboldened calls from the business community to lower the interest rate to spur growth.

However, core inflation remains sticky at around 6.8%, and the central bank has historically prioritized core inflation trends over transient food or fuel price movements. Moreover, with energy price adjustments still pending and possible second-round effects of currency depreciation, the SBP is likely to take a “wait and see” approach.

| Indicator | Latest Value | Previous Value |

| Headline Inflation (Apr) | 0.30% MoM | 0.70% MoM |

| Policy Rate | 12.00% | 12.00% |

| Core Inflation | ~6.8% YoY | ~6.9% YoY |

| SBP FX Reserves | ~$8.2 billion | ~$7.9 billion |

Why the SBP May Hold the Line

There are three main reasons why analysts believe the SBP will maintain the current rate:

- IMF Considerations: Under the Extended Fund Facility (EFF) negotiations, the IMF has emphasized the need for tight monetary policy to anchor inflation expectations. Any premature easing could be viewed as deviation from reform commitments.

- Exchange Rate Stability: The rupee has shown relative stability in the interbank market, but the SBP remains cautious. Lowering interest rates could weaken the currency if capital outflows begin, undoing recent FX reserve gains.

- Fiscal Pressures Ahead: With the federal budget due in June, the SBP might want to avoid influencing inflation expectations or creating liquidity distortions before the next budget cycle begins.

Business Outlook and Market Sentiment

Despite the prevailing high borrowing costs, the business community continues to press for monetary easing, citing stagnant industrial output and rising unemployment. The Pakistan Business Council (PBC) and Karachi Chamber of Commerce and Industry (KCCI) have both submitted memorandums urging a rate cut of at least 100–150 basis points.

However, treasury analysts and market watchers surveyed by Business Recorder overwhelmingly predict a no-change decision in the upcoming Monetary Policy Committee (MPC) meeting, with most citing caution over premature loosening of financial conditions.

A Case for Gradual Easing—But Not Yet

The SBP, known for its conservative monetary stance in recent cycles, is likely to wait for two to three more months of consistent inflation moderation before initiating a rate cut cycle. While economic momentum is subdued, the SBP may consider a modest reduction in the policy rate in the second half of 2025, contingent upon continued disinflation and external account stability.

In sum, the May 2025 monetary policy decision is expected to favor continuity over change, with the policy rate held steady at 12%. This approach reflects the central bank’s preference for data-driven policy adjustments, especially in a macroeconomic environment still navigating fragility and structural imbalances.

This article was published on Publicfinance.pk.