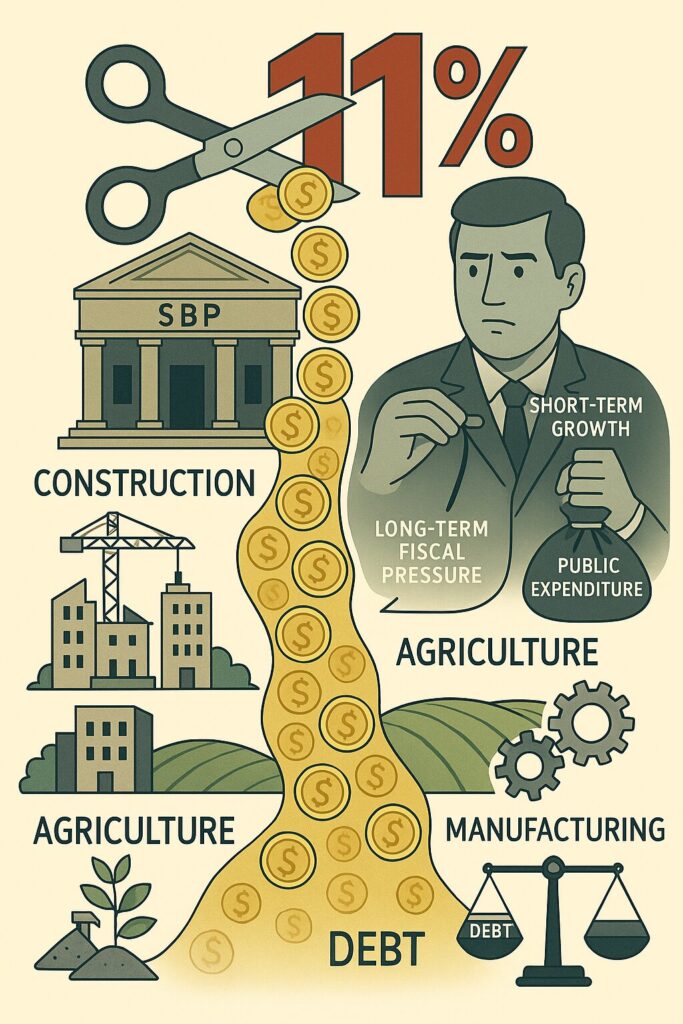

In a move that caught many by surprise, the State Bank of Pakistan (SBP) has reduced its benchmark interest rate by 100 basis points, bringing it down to 11%—the lowest level since March 2022. This decision, announced on May 5, 2025, marks a significant shift in the country’s monetary policy and has far-reaching implications for Pakistan’s public finances.

Monetary Easing Amidst Easing Inflation

The SBP’s decision comes on the heels of a notable decline in inflation. April’s inflation rate stood at a mere 0.3% year-on-year, a significant drop from previous months. This decline is attributed to reduced administered electricity tariffs and easing food prices, which have collectively contributed to a more favorable inflation outlook. Core inflation also saw a decrease, aided by a favorable base and moderate demand.

Implications for Public Finances

The reduction in the policy rate is expected to have a multifaceted impact on Pakistan’s public finances:

- Debt Servicing Costs: With the policy rate now at 11%, the government’s borrowing costs are anticipated to decrease. This reduction can lead to significant savings in debt servicing, freeing up resources for other developmental expenditures.

- Fiscal Deficit Management: Lower interest rates can stimulate economic activity, potentially increasing tax revenues. Enhanced revenues can aid in narrowing the fiscal deficit, a longstanding challenge for Pakistan’s economy.

- Investment in Public Projects: Cheaper borrowing costs can encourage the government to invest more in infrastructure and public welfare projects, fostering economic growth and employment.

Balancing Growth and Stability

While the rate cut aims to stimulate economic growth, the SBP remains cautious. The Monetary Policy Committee (MPC) acknowledged ongoing global risks, including uncertainty over trade tariffs and geopolitical tensions. These factors necessitate a balanced monetary stance to ensure that the benefits of the rate cut are not offset by external shocks.

Looking Ahead

The SBP’s decision reflects a strategic move to support economic recovery while maintaining price stability. As the economy responds to this monetary easing, the central bank will need to monitor inflation trends and external factors closely. The effectiveness of this policy shift will largely depend on the government’s ability to implement complementary fiscal measures and structural reforms.

This article was published on publicfinance.pk.