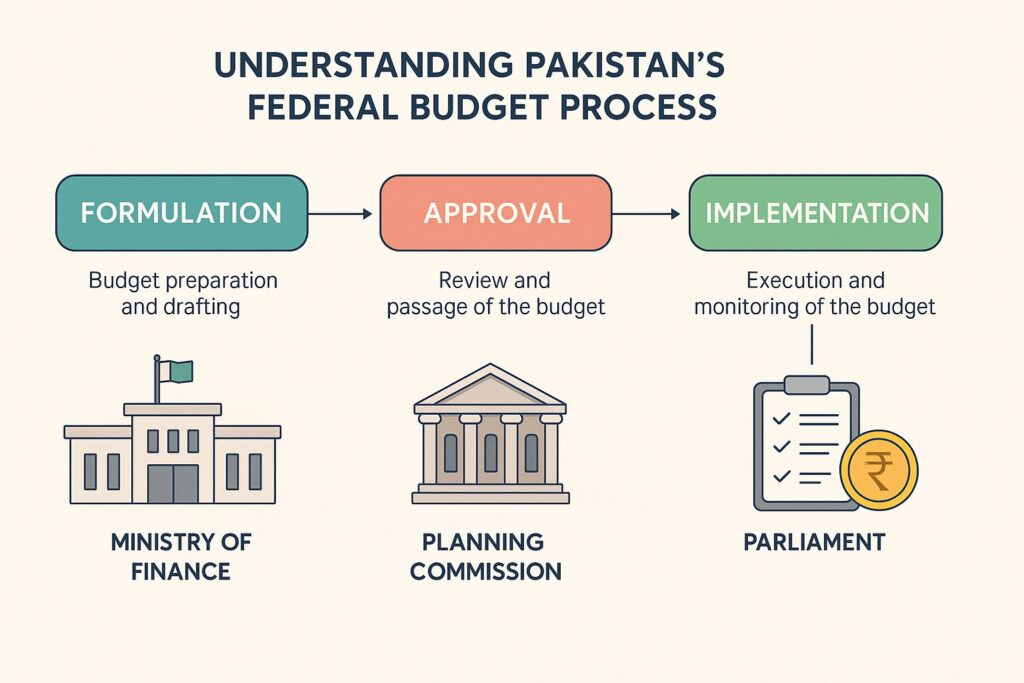

Pakistan’s federal budget is more than an annual financial statement—it is a reflection of the government’s policy priorities, economic strategy, and commitment to addressing national challenges. Each year, the budget cycle involves meticulous planning, rigorous debate, and structured implementation to allocate resources across sectors such as healthcare, education, infrastructure, and defense. Understanding this process is critical for stakeholders ranging from policymakers to citizens, as it shapes fiscal stability and public service delivery. Here’s a breakdown of how Pakistan’s federal budget is formulated, approved, and executed.

The Formulation Phase: Stakeholders and Strategic Planning

The budget-making process begins in October, led by the Ministry of Finance. It issues a Budget Call Circular to federal ministries, divisions, and departments, outlining guidelines for expenditure proposals. Key stakeholders, including provincial governments (post-18th Amendment), private sector representatives, and international institutions like the IMF, provide input during consultations. For instance, provincial needs are incorporated to align federal allocations with decentralized responsibilities such as health and education.

By March, preliminary estimates for revenues (taxes, non-tax receipts) and expenditures (development vs. non-development) are prepared. The National Economic Council (NEC) reviews the Public Sector Development Program (PSDP), which prioritizes infrastructure and social projects. Recent budgets have emphasized climate resilience and energy sector reforms, reflecting shifting national priorities.

Key Stakeholders in Formulation:

- Ministry of Finance (anchor agency)

- Federal ministries and departments (sector-specific demands)

- Provincial governments (coordination under NFC Awards)

- IMF and multilateral institutions (policy conditionalities)

Parliamentary Scrutiny and Approval

The Constitution mandates the government to present the budget to the National Assembly by June 1. Once tabled, the document undergoes rigorous scrutiny: standing committees analyze allocations for their respective sectors, while members propose amendments. For example, in 2023, the National Assembly’s Finance Committee revised energy subsidies to redirect funds toward social protection programs.

The National Assembly typically debates the budget for 10–15 days, followed by a vote on the Finance Bill, which includes tax proposals. While the Senate cannot block the budget, its recommendations often influence public discourse. Approval by June 30 is constitutionally required to avoid a shutdown.

| Key Milestones | Timeline |

|---|---|

| Budget Presentation | Early June |

| Committee Reviews | Mid-June |

| NA Debate & Amendments | Late June |

| Presidential Assent | June 30 (deadline) |

Implementation, Monitoring, and Challenges

Post-approval, the Finance Division releases quarterly funds to ministries, guided by the Budget Execution Plan. The Accountant General of Pakistan (AGPR) monitors expenditures, while mid-year reviews assess performance.

External factors like IMF loan conditions (e.g., tax base expansion or subsidy reductions) often dictate fiscal adjustments. Political instability further complicates execution; supplementary budgets are sometimes introduced to address emergencies.

Persistent Challenges:

- Revenue shortfalls (tax-to-GDP ratio remains at ~10%)

- Under-execution of development budgets

- Political economy of subsidies and entitlements

Pakistan’s federal budget process is a complex interplay of technocratic planning and political negotiation. While institutional frameworks exist to ensure transparency, gaps in execution and accountability persist. Strengthening parliamentary oversight, improving intergovernmental coordination, and leveraging technology for real-time expenditure tracking could enhance efficacy. As the country navigates economic headwinds, the budget remains a vital tool for equitable resource distribution and sustainable growth.

This article was published on PublicFinance.pk.