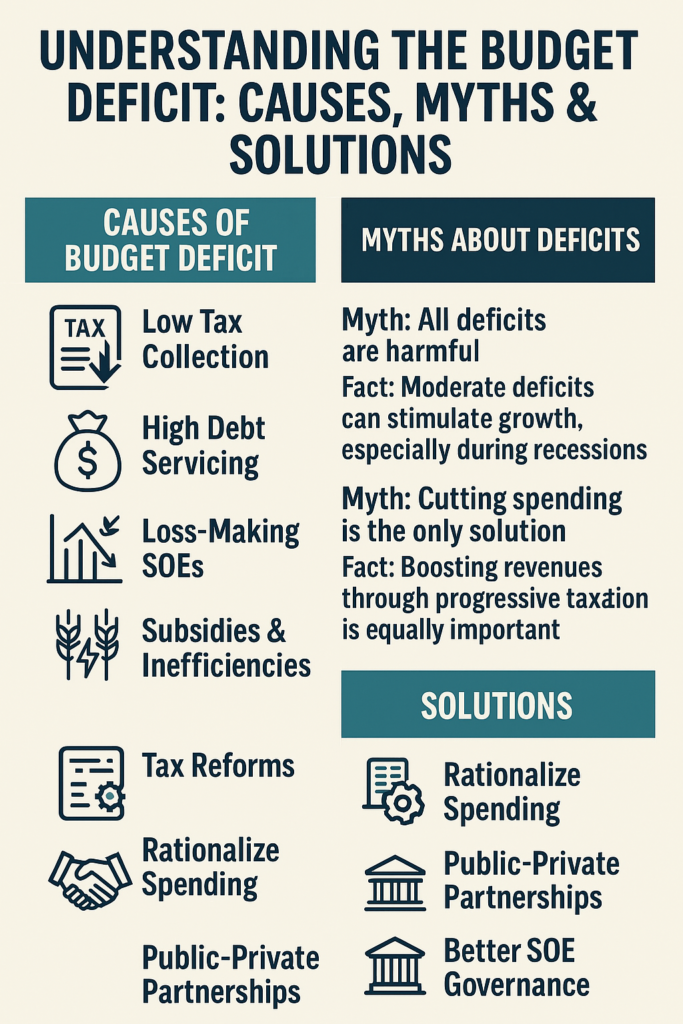

A budget deficit occurs when a government’s expenditures exceed its revenues. Pakistan has been grappling with high fiscal deficits for decades, which has implications for inflation, debt accumulation, and economic stability. Let’s explore what drives the deficit, the myths surrounding it, and how it can be managed.

Causes of Budget Deficit

- Low Tax Collection: With a tax-to-GDP ratio of just 9.2%, Pakistan collects far less than comparable economies. Tax evasion, a narrow tax base, and inefficient administration contribute significantly.

- High Debt Servicing: Debt servicing consumes more than 50% of current expenditures, crowding out spending on development and social sectors.

- Loss-Making SOEs: State-owned enterprises like PIA and Pakistan Railways continue to incur massive losses, requiring regular bailouts.

- Subsidies & Inefficiencies: Energy and food subsidies, though politically popular, often benefit wealthier segments more than the poor.

Myths about Deficits

- Myth: All deficits are harmful. Fact: Moderate deficits can stimulate growth, especially during recessions.

- Myth: Cutting spending is the only solution. Fact: Boosting revenues through progressive taxation is equally important.

Solutions

- Tax Reforms: Broaden the tax base, digitize tax collection, and reduce exemptions.

- Rationalize Spending: Shift expenditures from non-developmental to developmental areas.

- Public-Private Partnerships (PPPs): Reduce reliance on government financing by attracting private investment in infrastructure.

- Better SOE Governance: Introduce performance contracts, transparency, and potential privatization.

Managing Pakistan’s budget deficit is not about austerity alone. It requires a balanced mix of revenue mobilization, efficient spending, and institutional reforms. Addressing the deficit prudently can free up resources for health, education, and infrastructure—sectors vital for inclusive growth.